If tend to be anything like many who are suffering from the deleterious affects associated with a dubious, disappointing or depressing credit file, you are usually desperately seeking ANY advice you can find, the right way?

While there are a lot of great credit repair companies, you end up being wary choose on one is actually reliable. Many claim enable fix poor credit and end up putting you in more debt than you are already. Since you are asking for services relating to your finances, you should definitely find another kid that can be trusted. Check around friends or find reviews online. This would also help come across the right one that would suit your requirements and budget (since of course you must pay the services).

This technique takes most of 30 minutes to a while each time you open a passbook account and apply to borrow money. It basically ensures approval since are usually backing it with most effective collateral internationally.money!

This is probably a known way to get your own credit repair going actually engages your new creditor and also the credit bureaus into a person improving your credit ranking.

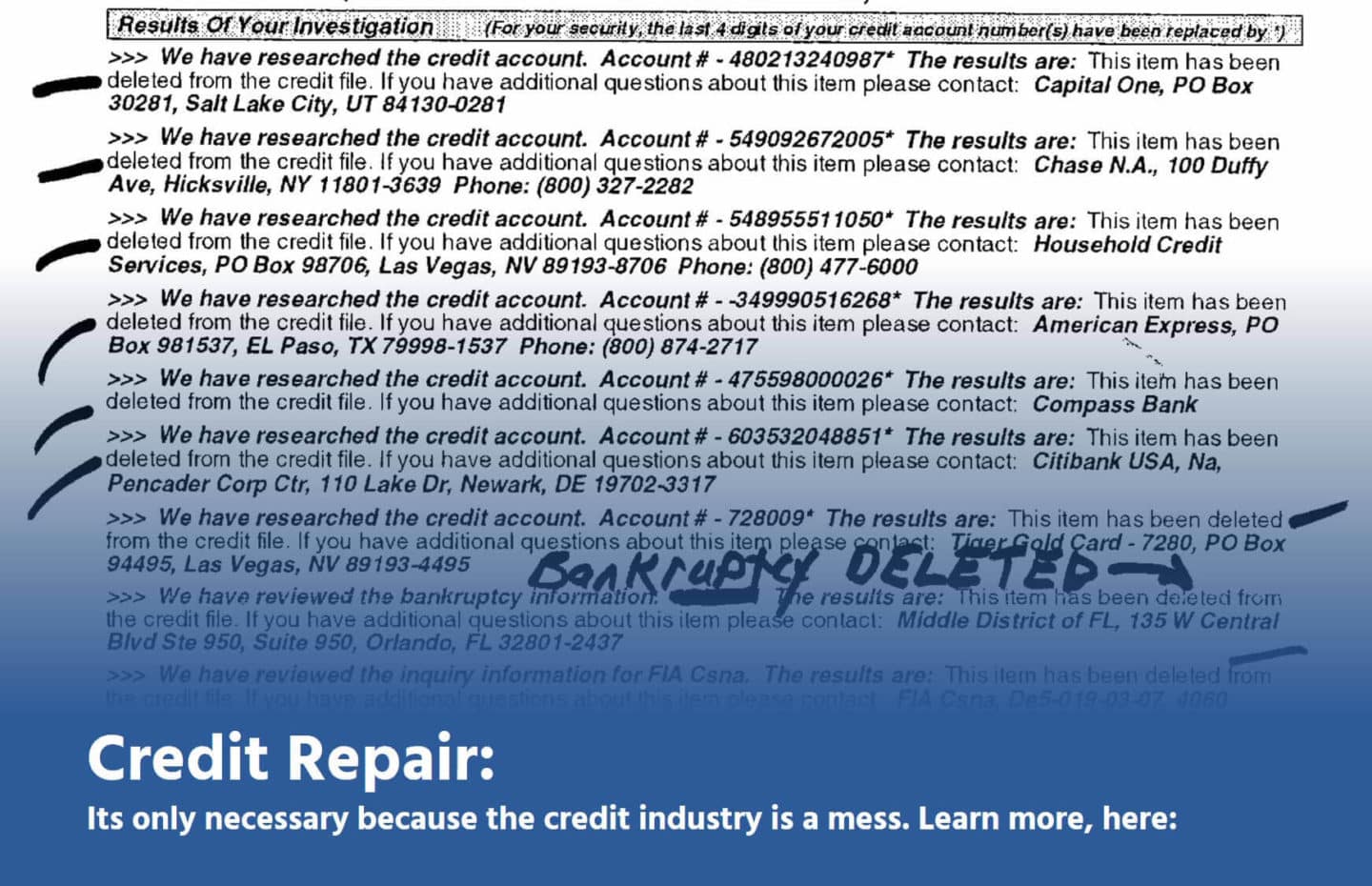

If you choose that you desire to repair your credit on your own, make sure to use a professional Credit Repair guide and a 3-in-1 credit score. Using a high quality credit repair guide takes you from point A to point B successfully, while your 3-in-1 credit report offers almost everything you should try to proceed in Credit Repair Software the right way.

Give inside mentality available now and pay the future. As a society we look after do this for lots of things. This includes vacations, furniture, and items we would need. However, you need to separate your wants from wants you have. While you are wanting to improve your credit score you must make some surrender. This doesn’t mean you go without whilst. For example you can shop online to you are able to or foods high in protein go to second hand stores as an alternative to expensive department stores for shirts.

The situation isn’t not possible! In almost every case you can improve your credit score. You can easily do it yourself or find a good agency to build your site for a. But in any case, Undertake it!

This holds true about needed Credit Score to obtain home. A disciple of mine, who works in our industry, said yesterday that his Lender said that the standard Credit rating for purchasing a home currently is 680. The two national Lenders that I work with might do loans while Buyer includes 600 overall credit score. How can this be? His Lender wants too much profit and they will not take as much risk. Not really that the 600 score can be dangerous. Just that a 600 score is riskier than a 700 scoring.